Renters Insurance in and around Daleville

Renters of Daleville, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Botetourt County

- Roanoke County

- Roanoke City

- Troutville

- Fincastle

- Eagle Rock

- Blue Ridge

- Clifton Forge

- Covington

- Salem

- Franklin County

- Bedford

- Virginia

- Buchanan

There’s No Place Like Home

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your couch to your guitar. Not sure how much insurance you need? That's okay! Kim Bergsten is here to help you evaluate your risks and help find insurance that is reliable and a good fit today.

Renters of Daleville, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Daleville Choose State Farm

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps guard your personal possessions in case of the unexpected.

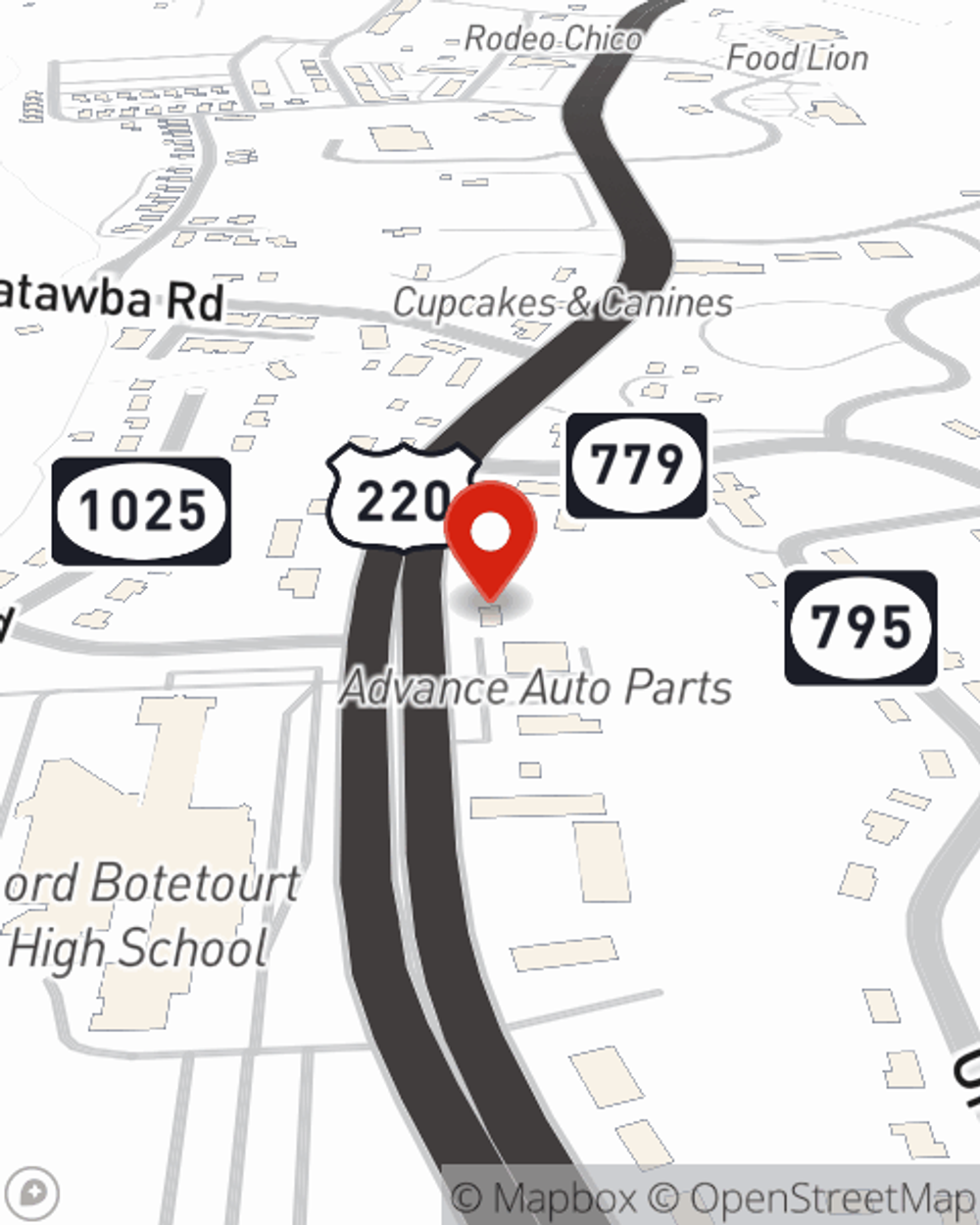

More renters choose State Farm® for their renters insurance over any other insurer. Daleville renters, are you ready to learn how you can protect your belongings with renters insurance? Reach out to State Farm Agent Kim Bergsten today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Kim at (540) 966-3276 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Kim Bergsten

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.